New money management app helps you stay in control of your wedding budget

Apart from the bride, the other big ‘b’ word when it comes to planning your wedding is ‘budget’. There’s no avoiding it whether you’re having a small or a large do, at home or abroad. Your bank accounts suddenly become awash with deposits, instalments, down payments and transfers flying out from your savings, current account, joint account and credit cards. No wonder so many wedding budgets spiral out of control.

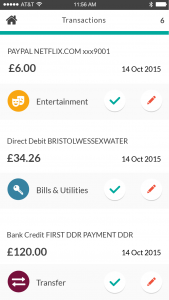

For those who are dreading the thought of this, there is thankfully an app which helps keep wedding finances under control. Moneyhub is a money management app for smart phones, tablets and desktop use which provides couples with a continuously up-to-date view of their personal finances. Through one log-in, the bride and groom can see the balance of their debit card, credit cards and savings all in one place. The app allows you to set specific spending goals in line with your budget, so you will truly know if you can afford those seat covers or not.

To ensure a financial ‘appy ever after, the app helps you manage your wedding finances by:

- Displaying your spending transactions from the previous three months when you first join, so you can start budgeting with accurate figures

- Allows you to set spending targets and alerts you to when you’re close to exceeding them

- Enables you to create bespoke, personalised categories for your spending transactions such as ‘wedding reception’, ‘evening do’ and ‘honeymoon’ as well as normal day-to-day categories (e.g. household, utility bills and eating out)

- Uses artificial intelligence (AI) technology and identifies trends on how you’re spending your budget – for example on flowers in comparison to decorations

- Provides ongoing month-by-month spending analysis

And most importantly, the app has certified bank level security, so you can rest assured all of your information is safe and protected. So with a bit more TLC around how you spend your wedding budget, maybe you can afford that extra night on honeymoon after all?

Dominic Baliszewski, personal finance expert from Moneyhub recommends the following top tips to make your wedding budget go further:

- Negotiate– Don’t be afraid to haggle with suppliers on quotes. If you’re in the fortunate position to do

so, offer to pay the lion’s share of a large payment upfront in return for a reduction on the overall price.

so, offer to pay the lion’s share of a large payment upfront in return for a reduction on the overall price. - Buy some time– Never feel forced to commit to something on the spot by persuasive sales people. Can you get the same product at a better price elsewhere?

- Make friends with your finances – Dedicate ten minutes every week to your finances to ensure everything has been accounted for, particularly if cash payments are made.

- Double trouble – If your partner is also spending from the same pot, make sure they always have a clear view on your current balance. You can’t spend the same money twice!

Sign up today at www.moneyhub.com for £2.99 a month or download the app for a seven days free trial.

Add new comment